Greenfield

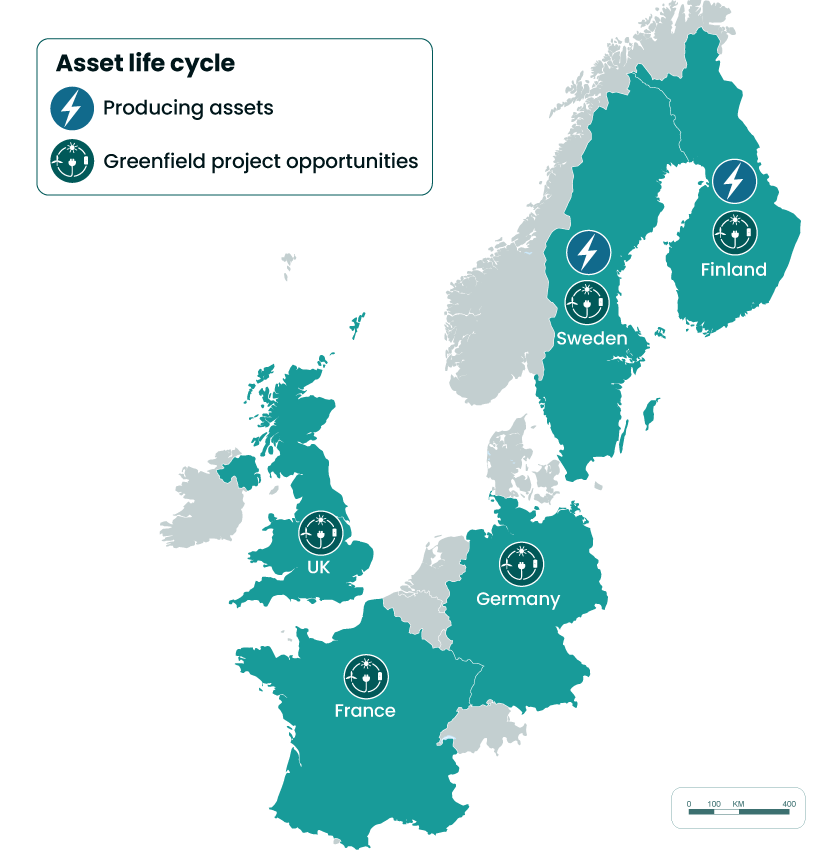

The Company is advancing a large-scale onshore greenfield portfolio consisting of solar and battery projects in the UK, Germany and France. It is also progressing small- and mid-scale greenfield projects in the Nordics. The projects are driven by experienced teams with a proven track-record in project origination and development in these markets. Project realisation depends on several factors, such as permitting, fulfilment of projects milestones and commercial viability.

The Company has a dynamic approach to creating value from its portfolio and seeks to explore options to divest projects throughout the value chain, subject to market conditions. For the largest projects, the strategy is to divest before significant construction costs are incurred.

UK, Germany and France

Since launching its large-scale greenfield business in 2023, the Company has a well-established platform for growth with a pipeline of large-scale solar and battery projects across the UK, Germany, and France. With experienced development teams in place, the Company is now advancing these projects to more mature stages.

- 2.5 GW of projects at Ready-to-Permit; one project with capacity of 1.4 GW of solar and 500 MW of battery, and one solar and battery project with capacity of 600 MW

- Sales process awaiting the conclusion of the ongoing grid connections reform in the UK, with feedback on the reform expected during the fall of 2025

- A pipeline of additional projects maturing towards the ready-to-permit phase

- First sales process initiated for a 98 MW Agri-PV project

- Additional German projects advancing towards Ready-to-Permit, with more sales processes to follow

- Optionality with agricultural solutions increase permittability

- Secured first land rights and accelerating efforts to acquire additional land

- Advancing initial projects towards the ready-to-permit milestone

Nordics

In the Nordics, the Company is progressing a range of stand-alone and co-located project opportunities with an estimated total capacity of around 1 GW, ranging from early-stage projects in the screening phase, through to projects with construction permits in place moving towards investment decisions. This allows the Company to organically grow its portfolio, optimise power generation and crystalise further value from its operational assets, which includes projects aimed at extending asset lifetimes, re-powering and consolidation of ownership.