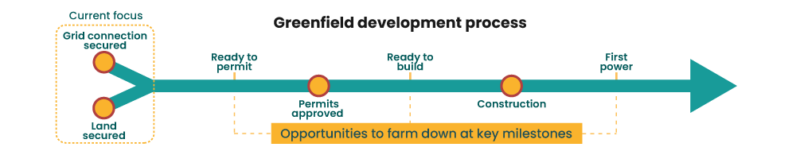

Greenfield development

The Company is pursuing onshore greenfield growth opportunities in France, Germany, the UK and the Nordics. This is led by an experienced development team, with a proven track-record of greenfield project origination and development in these markets.

Europe

In the UK, the Company has secured a portfolio of grid connections with a capacity of over 20 GW for solar projects and over 10 GW of co-located battery projects with grid energisation dates between 2030 and 2039. The Company is working on obtaining access to land adjacent to the secured grid connections, and has entered into discussions around commercial terms for land leases. The grid portfolio is at an early-stage and final project realisation will be dependant on a number of factors, such as access to land, permitting, fulfilment of projects milestones and commercial viability.

Nordics

In the Nordics, the Company has identified a range of stand-alone greenfield as well as co-located project opportunities, ranging from early-stage projects in the screening phase, through to projects with construction permits in place moving towards investment decisions. The identified project opportunities are across proven and low-cost onshore technologies; wind energy, solar energy and battery storage, which when realised will diversify the Company’s power generation capacity and revenue streams.

Permit applications for 29 MW of battery storage and solar projects in Sweden have been submitted, out of which permits enabling battery projects up to 14 MW have been obtained. The Company intends to invest in battery storage solutions, providing ancillary services and enabling the addition of new revenue streams.

In addition, the Company is actively exploring opportunities to optimise the revenues of its assets by becoming active in the frequency and ancillary services markets. Feasibility studies have been conducted to use the Company’s largest wind farms, MLK and Karskruv, to provide grid stabilisation services and the Company’s expectation is that MLK will be qualified by the transmission system operator by the end of 2023, and Karskruv in early 2024 shortly after project completion.

Organic growth

Orrön Energy is exploring and maturing a wide range of opportunities in its existing portfolio aimed at optimising power generation performance and enhancing returns from the company’s operational assets. This includes projects covering life extension, re-powering, ancillary services and optimised utilisation of existing land rights and grid connections. Additionally, studies have been undertaken to determine the potential of adding new power generation and energy storage solutions to existing assets. Support from local grid operators has resulted in progress towards permitting for co-location projects on several wind farms, where land and access to the grid has already been secured through existing operational assets. The Company has submitted permit applications for a small-scale co-located solar installation adjacent to the Näsudden wind farm and for a co-located battery project adjacent to one of the Company’s wind farms in the price area SE4.

In addition, the Company is actively exploring opportunities to optimise the revenues of its assets by becoming active in the frequency and ancillary services markets. Feasibility studies have been conducted to use the Company’s largest wind farms, MLK and Karskruv, to provide grid stabilisation services and the Company’s expectation is that MLK will be qualified by the transmission system operator by the end of 2023, and Karskruv in early 2024 shortly after project completion.