Orrön Energy is uniquely positioned for growth

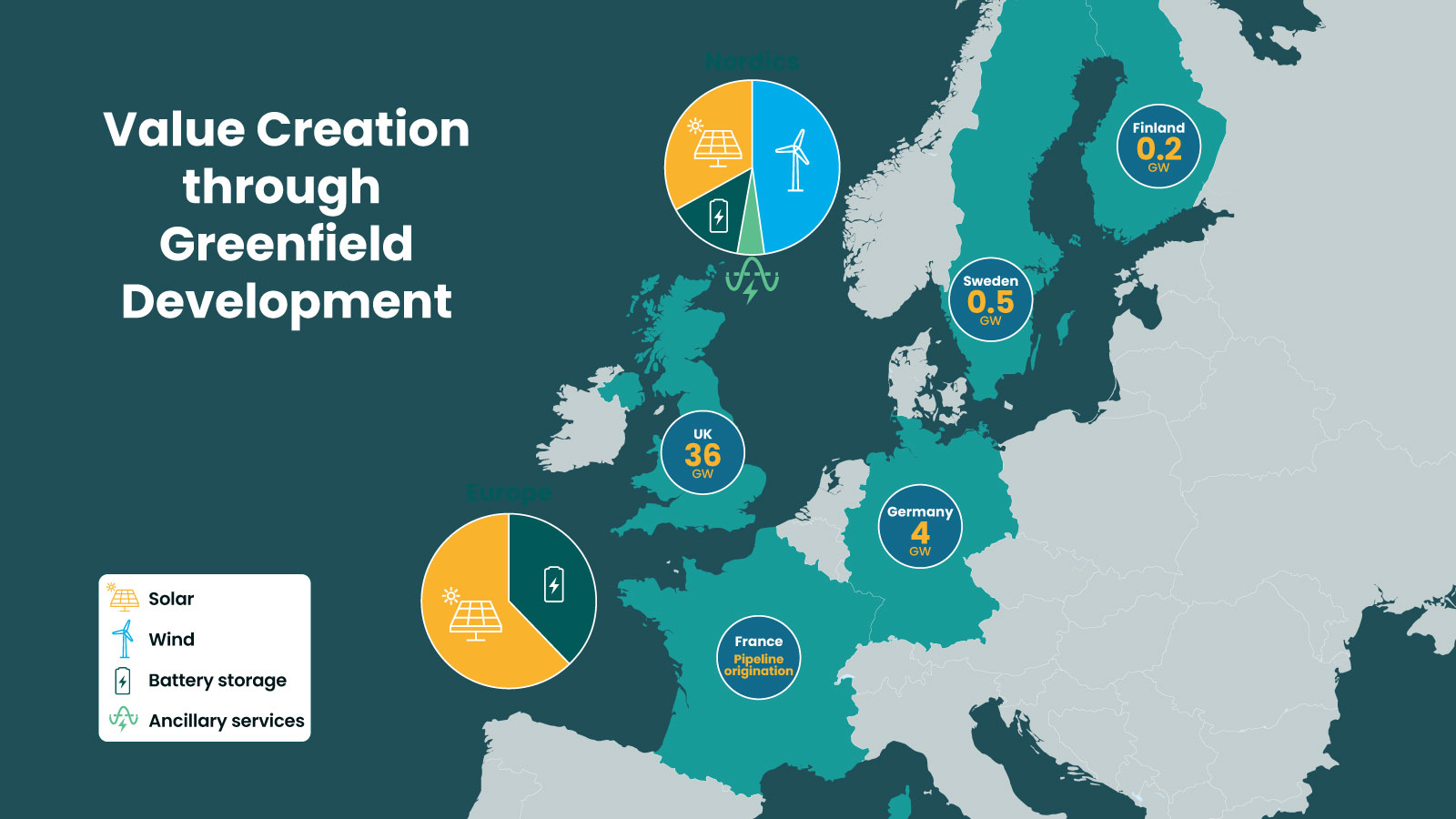

Orrön Energy is one of the largest independent publicly listed renewable energy companies in Sweden, with cash-flowing renewable energy assets in the Nordics, and a pipeline of greenfield opportunities in solar, wind and battery projects in the Nordics and Europe.

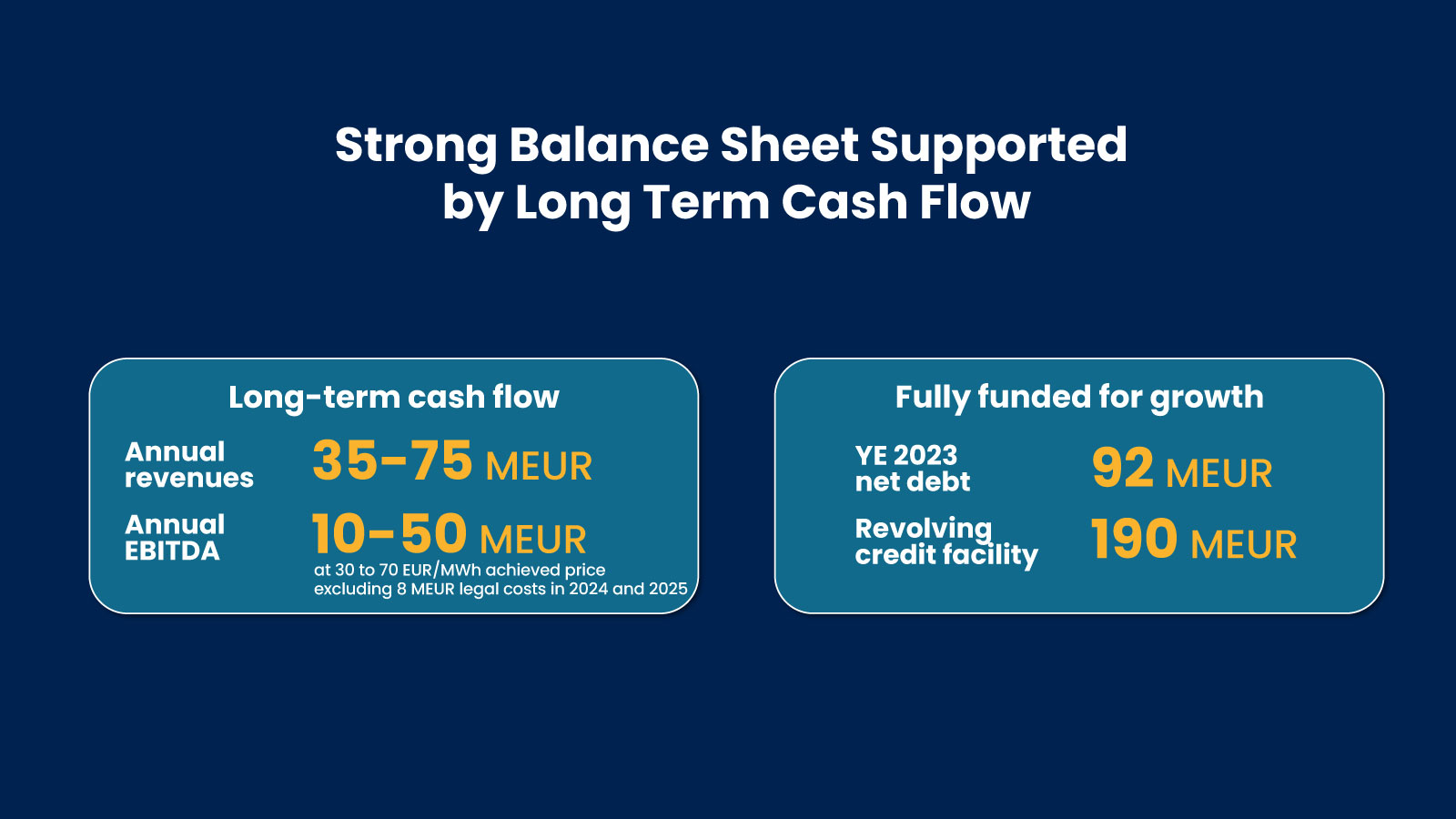

The Company has strong financial capacity to fund further growth, and is aiming to create long-term shareholder value by having an opportunistic approach to value creation.

The demand for renewable energy in Europe is expected to grow significantly in the coming years, and massive investments will be needed to accelerate decarbonisation across societies and industries. Orrön Energy is in a unique position to grow and take advantage of opportunities created by the energy transition, with strong financial backing and activity in all stages of the renewables lifecycle; from early stage developments to the operational phase. A number of greenfield projects are being matured, for which the Company will have the opportunity to invest or farm down depending on market conditions. In addition, the Company is constantly working on optimising and organically grow its operational portfolio in the Nordics, by value accretive acquisitions, projects aimed at extending asset lifetimes and by taking part in the ancillary and frequency markets.

Orrön Energy is part of the entrepreneurial Lundin Group of Companies, and has a management team and Board with a proven track record of investing into, leading and growing highly successful companies of scale.

Latest investor information

For more information

- Download our latest quarterly report

Year End report 2023

1.3 MB - Visit our webcasts page and watch our latest presentation

For more information please contact

Robert Eriksson, Director, Corporate Affairs and Investor Relations

Tel: +46 701 11 26 15

robert.eriksson@orron.com