Orrön Energy is well positioned to create long-term value

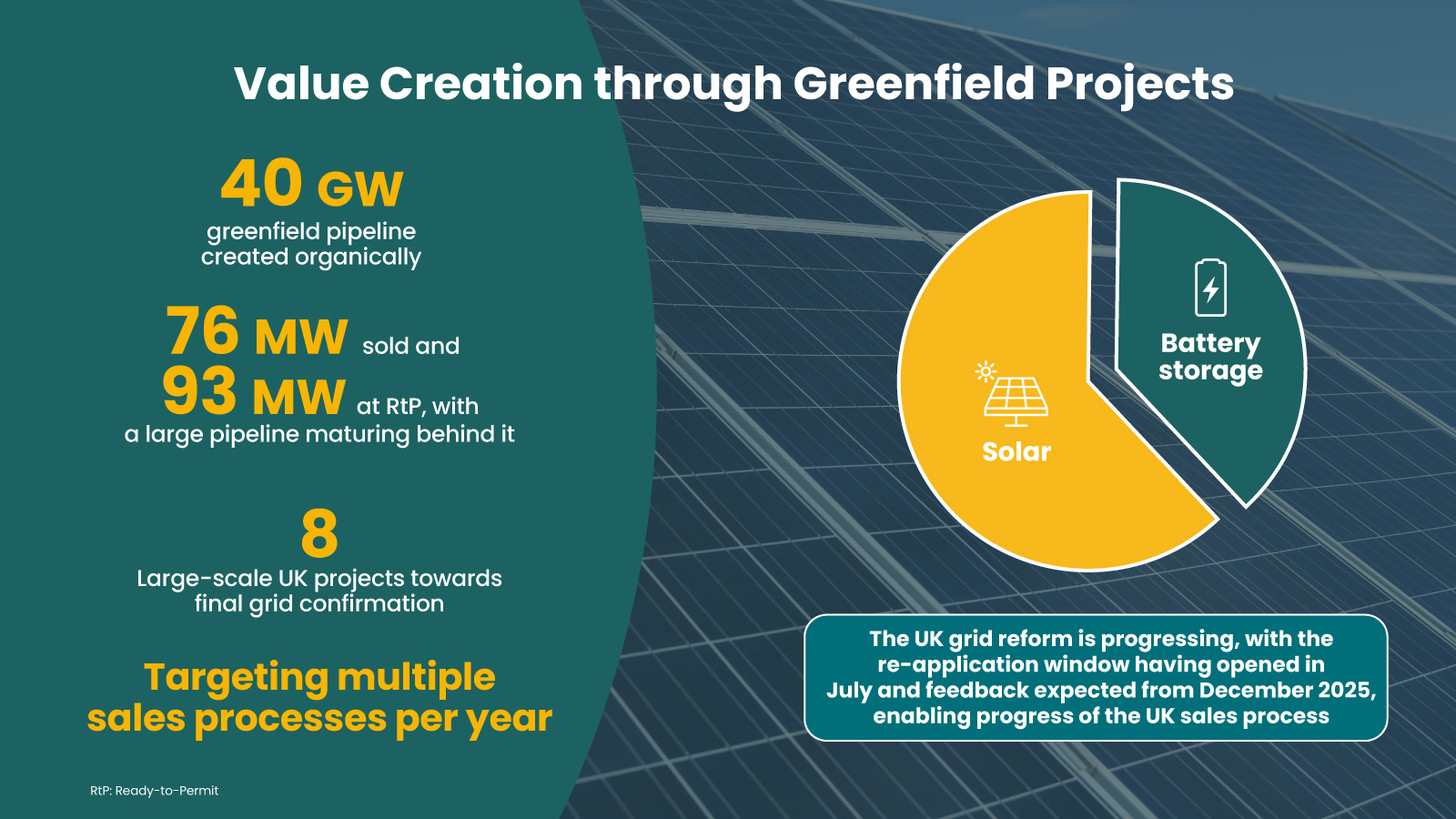

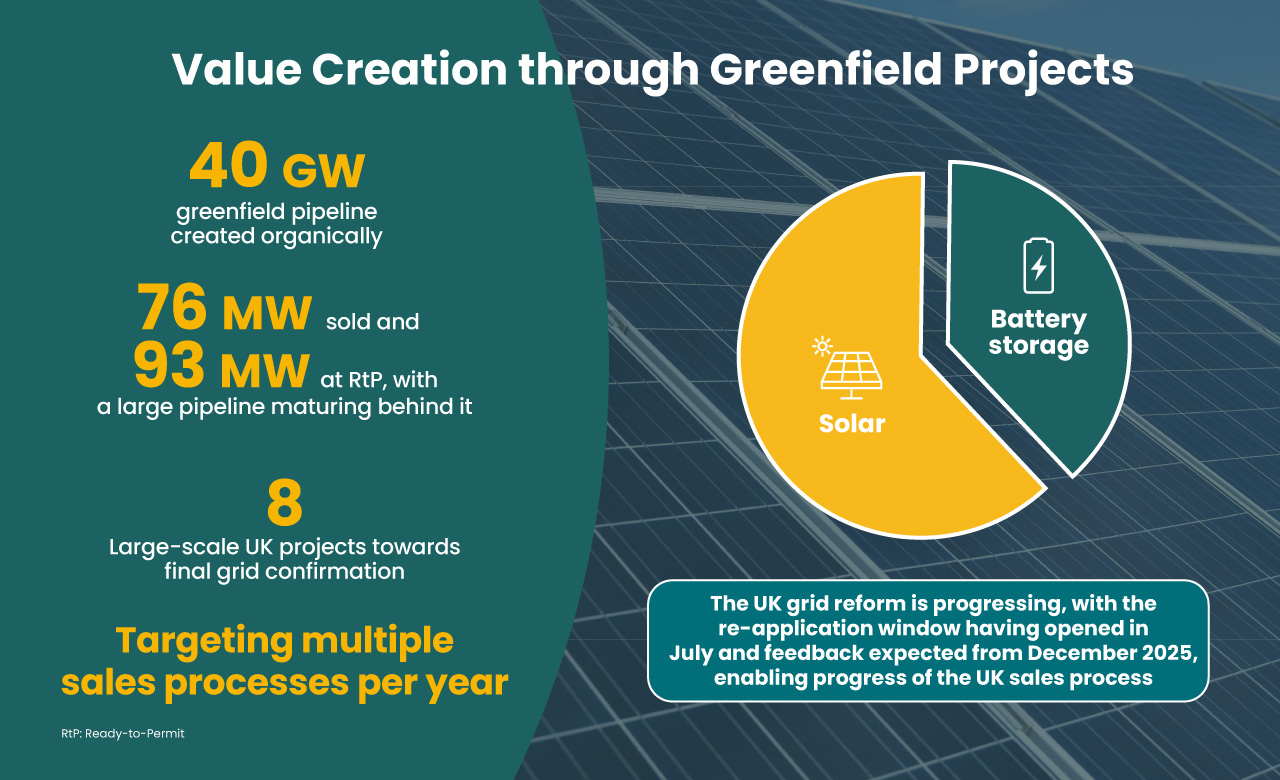

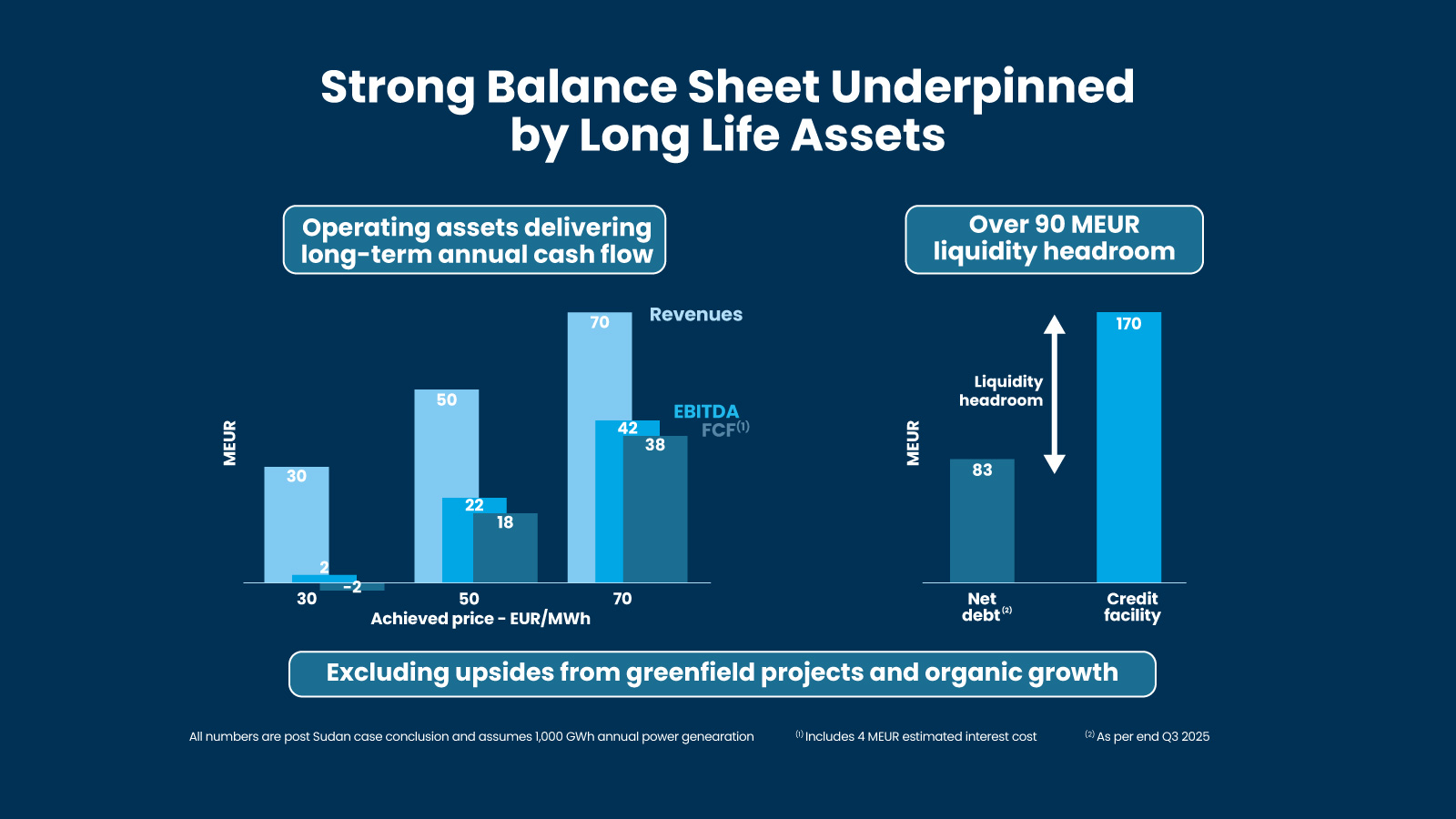

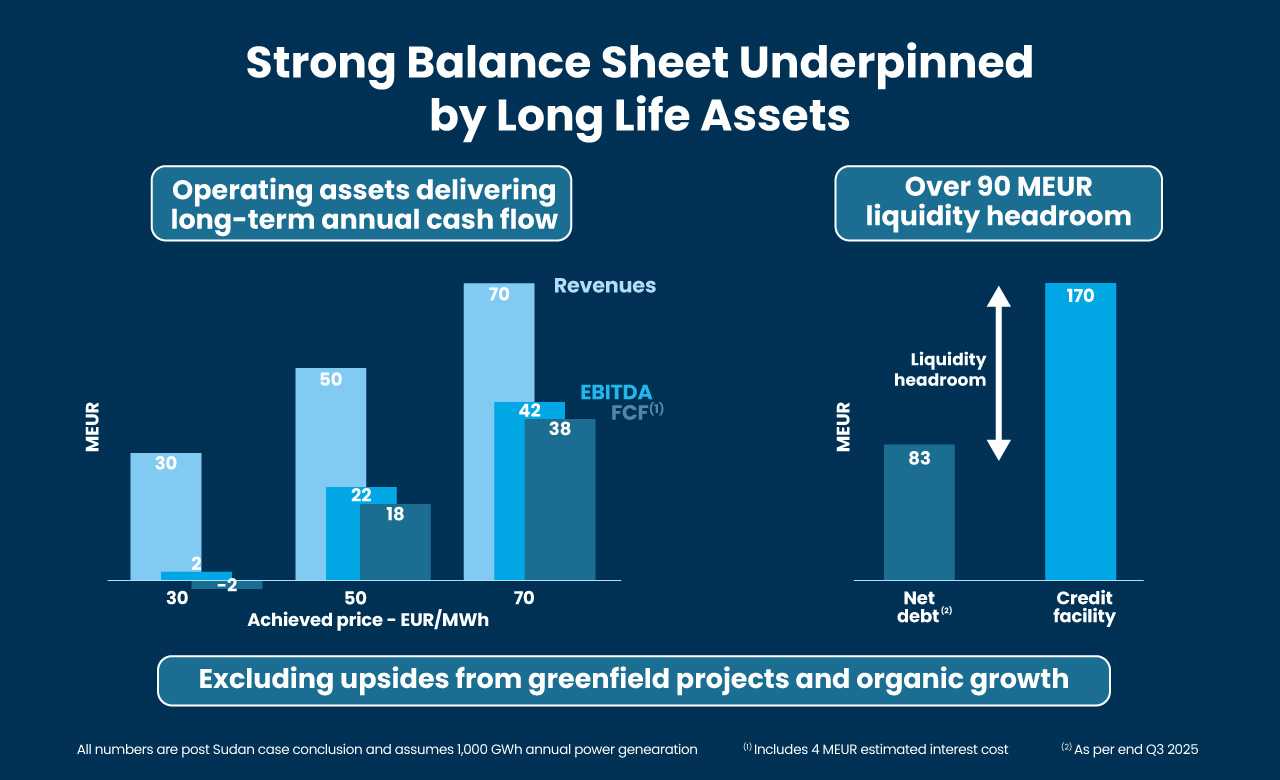

Orrön Energy (Nasdaq Stockholm “ORRON”) is a Swedish renewable energy company, with cash-generating wind power assets in the Nordics, and a pipeline of greenfield projects in the Nordics, UK, Germany and France. The Company aims to create long-term value for its shareholders by growing its portfolio of cash-generating assets and by having a dynamic and return-driven approach to monetising its greenfield pipeline.

The European demand for renewable energy is expected to grow significantly in the coming years, and massive investments will be needed to accelerate decarbonisation across societies and industries. With a strong financial position and a management team and Board that have a proven track record of investing into, leading and growing successful companies of scale, Orrön Energy is well positioned to create long-term value through the energy transition.

Latest investor information

For more information

- Download our latest quarterly report

Nine month report 2025

691 KB

Latest investor information

For more information

- Download our latest quarterly report

Nine month report 2025

691 KB

Subscribe

Subscribe to our press releases and receive them by e-mail as soon as they are published.

For more information please contact

Robert Eriksson, Corporate Affairs and Investor Relations

Tel: +46 701 11 26 15

robert.eriksson@orron.com